Guide to Student Loan Debt

Read on to learn more about the different types of student loans, steps you can take to pay less for college, and how to get rid of crushing student debt after the fact.

Overview

Research shows that college graduates earn hundreds of thousands of dollars more over the course of their careers, but that only tells part of the story. The fact is, those who attend college often have to rack up considerable student debt to do so, and they may spend years — and even decades — putting off other financial goals so they can keep up with the monthly payments.

In fact, data from the Board of Governors of the Federal Reserve system shows that 30% of adults incurred some form of debt to obtain higher education as of May 2021. Further, 20% of adults still carry student loan debt, with adults under the age of 30 being significantly more likely to have taken out loans than their older, more established peers.

Average student loan debt in 2020 for those who borrowed for their own education came in between $20,000 and $24,999, based on these recent stats. Of course, many borrowers owe significantly more than that. In fact, recent data from The Brookings Institute revealed that 6% of student borrowers owed at least six figures ($100,000 or more) toward their student loans in the same year.

These figures likely leave you with plenty of questions, particularly if you are heading off to college and hoping to avoid or minimize student debt. For example, how do the student loans that lead to so much borrowing actually work? Also, what steps can someone take to borrow less without sacrificing the quality of their education?

This guide to student debt will answer those questions and plenty of others.

What Are Student Loans?

A student loan is a source of funding college students rely on to pay for higher education. The expectation is that college students will pay back their loan funds in the future, along with any required loan fees with interest that accrues over time.

Student debt is the result of borrowing money to pay for higher education, and the amount of debt after graduation can vary. Either way, it's important to note that student loans can become a blessing or a curse. While student loans used wisely can help you move into a rewarding and profitable career that accelerates your earnings, student debt racked up haphazardly can leave you struggling with your finances for years to come.

Federal vs. Private Student Loans

Before you look into borrowing money to pay for college, it's crucial to understand the different types of student loans and their pros and cons. Generally speaking, you can choose from federal student loans that are backed by the federal government and private student loans that are offered through independent lenders.

Since federal student loans are offered by the government, they come with extended protections you won't get with private student loans.

If you need to borrow money for college, you'll want to take advantage of all federal aid options you have access to first. Federal student loan options can include:

Direct Subsidized Loans and Direct Unsubsidized Loans

Direct PLUS Loans (for graduate and professional students)

Direct PLUS Loans (for parents)

Since federal student loans are offered by the government, they come with extended protections you won't get with private student loans. For example, federal student loans come with fixed interest rates that are updated just once per year for the following academic year. They also help students qualify for federal deferment and forbearance programs. Federal student loans are also eligible for income-driven repayment plans, which base your monthly payment on how much you earn, as well as forgiveness programs, like Public Service Loan Forgiveness (PSLF).

By contrast, private student loans are offered through online lenders, banks, credit unions, and other financial institutions. These lenders can set their own rates and terms, and the loans they offer don't come with the same protections you get with federal student loans.

There are additional differences between these types of student loans to be aware of, including when payments are due and their eligibility requirements. The chart below highlights the main differences between federal and private student loans:

| Common Questions | Federal Student Loans | Private Student Loans |

|---|---|---|

| When are my payments due? | After you graduate, leave school, or change your enrollment status to less than half-time | During school or after you graduate |

| What type of interest rates are available? | Fixed interest rates that won't change for the life of the loan | Interest rates can be fixed or variable |

| What subsidies are available? | Some federal student loans are subsidized, meaning the federal government covers interest charges while you're still in school | Private student loans accrue interest right away |

| Is a credit check required? | No credit check for federal student loans for studentsFederal student loans for parents require a credit check | Credit check required, and you typically need good credit or a cosigner with established credit to qualify |

| What financial assistance can I receive? | Can qualify for deferment or forbearance | Rarely qualify for any deferment or forbearance programs |

| What are the prepayment penalties? | No penalty for paying your student loans off early | Varies by lender |

| What are the forgiveness options? | Can qualify for income-driven plans, PSLF, and other forgiveness plans | No access to federal repayment plans or forgiveness options |

Can Student Loans Be "Worth It?"

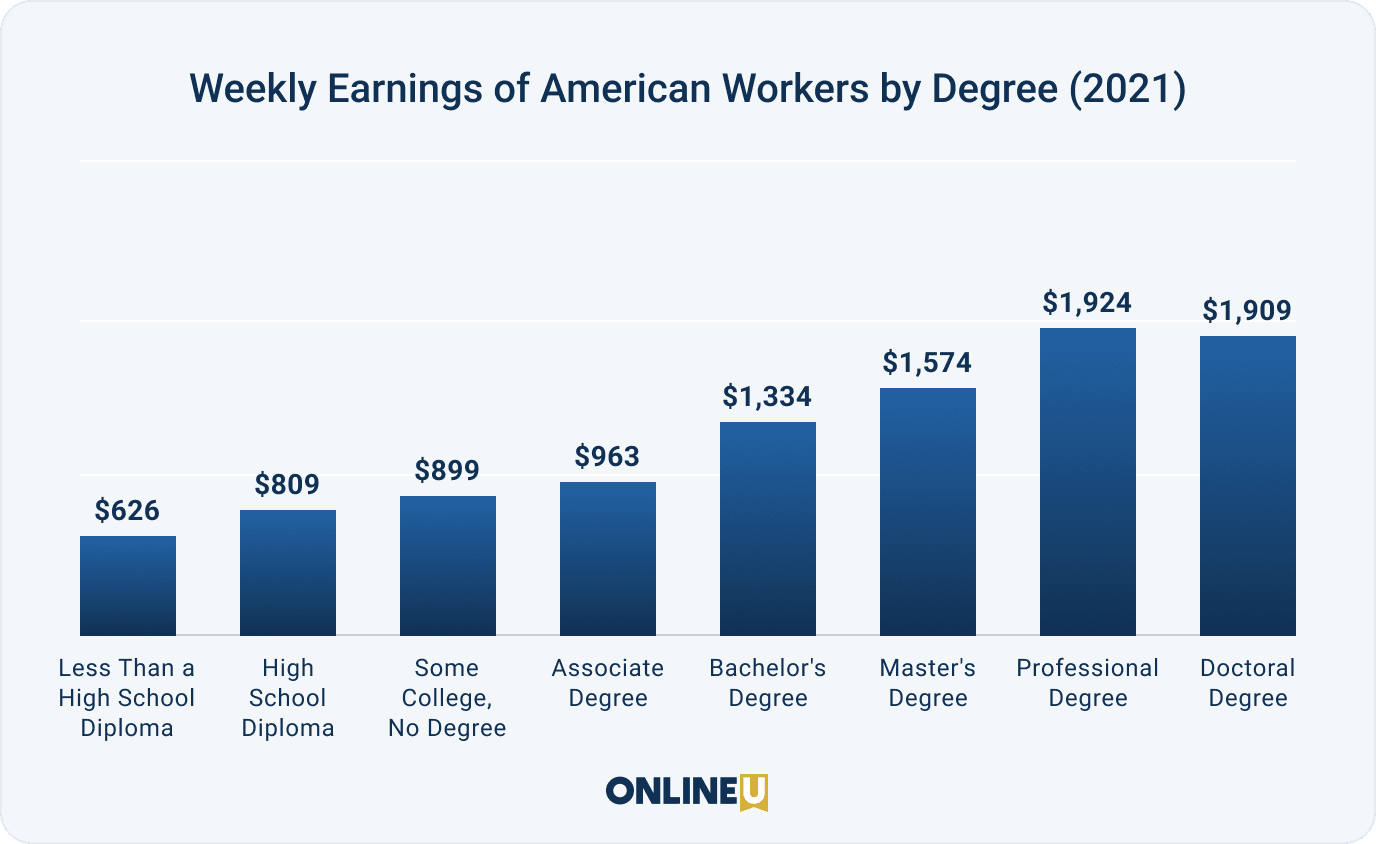

Is racking up student debt ever worth it? It certainly can be. Research released by the Bureau of Labor Statistics (BLS) lays this fact out plainly by showing how much the average person earned in 2021 based on educational attainment.

Per the BLS, American workers earned the following median weekly earnings in 2021:

As you can see, the attainment of a bachelor's degree is where incomes really accelerate, and they only go up from there. With that in mind, it's easy to see how earning a college degree with the help of student loans can be worth it. However, borrowing smartly and with restraint is the best way to get a solid return on your investment.

Watch Out for Overborrowing, Predatory Lending Practices, and Scams

While borrowing money for college can make financial sense, you'll need to watch out for an array of pitfalls and predatory lending practices that can leave you saddled with more debt.

Potential problems to watch out for can include the following:

- Overborrowing to attend overpriced, for-profit schools: According to the National Bureau of Economic Research (NBER), students who choose for-profit schools over public schools wind up borrowing more, default on their student loans at a higher rate, and find employment at lower rates. Generally speaking, college students are much better off attending public schools that boast higher graduation rates and better economic outcomes.

- Pressure to take out private student loans: The Consumer Financial Protection Bureau (CFPB) has reported that myriad predatory lending practices have been uncovered and rectified within the private student loan market over the last decade. However, private student loans are still riskier for borrowers since they do not come with the same protections as federal student loans. The CFPB notes they also tend to cost more in interest charges and fees over time.

Student aid scams: The US Department of Education lists several types of student loan scams to watch out for, including high-pressure marketing materials for overpriced loans, false promises of loan forgiveness, and companies asking borrowers to pay a fee to access aid options. Make sure you're always aware of current student loan scams so you can avoid them at all costs.

How To Avoid Student Debt

Earning a bachelor's degree requires a considerable financial investment. After all, recent College Board figures show that the cost of tuition and fees at public, four-year in-state schools worked out to $10,740 nationallyper year for the 2021-2022 school year.

With that in mind, student loan experts recommend taking steps to minimize borrowing for college, or to borrow a "reasonable amount" based on the degree you plan to pursue.

Student loan expert Robert Farrington of The College Investor offers this advice when figuring out how much student loan debt is a reasonable amount:

EXPERT TIP

"A good rule of thumb is to never borrow more than you expect to earn in your first year after graduation. So, if you want to be a teacher, know that the average teacher earns a starting salary of $38,617. Don’t borrow more than that!"

What steps can you take to pay less and borrow less for college? Consider the following tips:

Consider community college first. Community college tuition at public, two-year schools worked out to just $3,800 for the 2021-22 school year per College Board figures. If you can attend community college for a couple of years before transferring to a four-year institution, your savings could be substantial.

Look into affordable online colleges. Compare the costs of pursuing an online degree to the costs involved at comparable brick-and-mortar schools. Also consider other ways you could save money by attending college virtually, including savings gleaned from living at home longer, avoiding a commute to school, and more.

Fill out the FAFSA. Make sure you fill out the Free Application for Federal Student Aid (FAFSA) every year, even if you think you won't qualify for assistance. This form helps the federal government, your state, and your school determine what financial aid you are eligible for, including federal student loans, work-study programs, grants, and more.

Apply for scholarships every year. While many college-bound students apply for scholarships before their first year of school, many lose motivation after that. According to Farrington, scholarships can be applied for and received every year of college, and not just the first. "So, don’t stop after year one," he says.

Explore tuition reimbursement programs offered by private companies. Farrington also adds that some employers offer tuition reimbursement as an employee perk. If you're unsure whether your employer offers this benefit, you can find out by checking with your human resources department.

Benefits To Choosing an Affordable Online School

Farrington points out that there's a lot of data available that can help you figure out which schools and degree programs are worth it. With that in mind, he strongly suggests researching career starting salaries, understanding the return-on-investment (ROI) of certain majors and schools, and planning accordingly.

"While college can be fun, and a great experience, it does cost money," he says. "And if you can still get the same results for significantly less money, it’s probably worth it."

Below are some sources that can help you research this information:

- Bureau of Labor Statistics

- Is College Worth It? A Comprehensive Return on Investment Analysis

- O*NET Online

- US Department of Education College Scorecard

With all this being said, there are quite a few benefits to be gained from choosing an affordable online school. For starters, many traditional colleges and universities have an online component that awards the exact same degrees you would earn if you attended school in person. These online programs are often less expensive than their on-campus counterparts, and students can save even more by living at home, reducing or eliminating transportation costs, and continuing to work while they attend college on a schedule that works around their other obligations.

Other benefits that can arise from choosing an affordable online school include the following:

Being able to compare college tuition and fees across multiple institutions without worrying about their geographic location

Pacing options, including the opportunity to choose a self-paced degree program

Scheduling flexibility, which can include the choice between daytime or evening and weekend classes

Learning opportunities that can apply to your future career, including the use of technological advances in video conferencing, online research, and more

Learn what steps you can take to save money while in college.

Planning for Your Financial Future

If you want to maximize your college education while minimizing your costs and final student debt load, you should have a plan together before you head off to college. After all, the school you choose to attend will play the biggest role in how much you pay for higher education as well as ways you may be able to cut down on spending while you earn your degree.

Steps that can help you plan for a bright financial future include:

1

Research future salaries for your chosen career and school. Before you select a college and degree program, you'll want to know how much graduates earn once they move into the workforce. Our salary score methodology is based on alumni salary after graduation, so this is a good place to start your research.

2

into online colleges that let you pay less for the same degree. Don't pay more for a degree than you have to. Instead, look into online schools that let you work through your chosen degree program at a much lower cost.Look

3

Run the numbers to figure out how much you might have to borrow. Fill out the FAFSA to see how much financial aid you are eligible for, if any. From there, figure out how much you may need to borrow for college based on your degree type. Also remember that your first year of college will cost the least, so you should expect to pay more for tuition and fees during subsequent years.

In addition to these steps, you should also play around with a student loan calculator to see how much you'll actually owe toward the amount of student loans you will likely have. From there, you can consider other expenses you will likely need to cover (i.e. rent or mortgage, car payment, utility bills, groceries, insurance, etc.) and how your student loan payment will impact your budget.

Once you have an idea of what your bills might look like, you can see how they stack up to the salary you will likely earn after you graduate from college. Does your student debt seem reasonable in light of your future income and other expenses? If not, you may want to rethink your college plans, your chosen degree program, or both.

How To Get Rid of Student Loan Debt

While limiting how much you have to borrow for college is the best way to set yourself up for financial success, you should know that you can ditch student debt sooner rather than later.

Student Loan Forgiveness Programs

First off, it's worth noting that many student debt forgiveness programs exist, although the terms and conditions of these programs vary. There are state-based student debt forgiveness programs that forgive the debts of borrowers who agree to work in public service. Additionally, there are federal debt forgiveness programs for teachers and other types of borrowers.

Another popular student debt forgiveness program is Public Service Loan Forgiveness (PSLF), which is available to borrowers who agree to work in eligible public service positions for ten years. Loans must be repaid on an income-driven repayment plan for 120 months before forgiveness can occur, and borrowers are required to maintain full-time employment with an eligible employer the entire time.

Income-driven Repayment Plans

Borrowers can also look into income-driven repayment plans for federal student loans. Programs that fall into this category let borrowers pay a percentage of their "discretionary income" for 20 to 25 years before forgiving remaining loan balances, and people with the lowest incomes may pay as little as $0 each month toward their loans.

Each income-driven repayment plan has slightly different terms and timelines, so you'll want to do your research. Plans to check out include Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), Income-Based Repayment Plan (IBR Plan), and Income-Contingent Repayment Plan (ICR Plan).

Employer Repayment Assistance

Many employers offer tuition assistance programs for their workers as an employee perk, mostly due to the tax benefits they receive. The fact is, employers can legally provide up to $5,250 per year in tuition assistance or student loan debt relief on a tax-free basis through 2025.

Not only is this assistance tax-free for the employer, but the worker is not required to pay income taxes on benefits up to this amount, either.

Refinancing Your Student Loans

Finally, you can always refinance your student loans, but this may involve risks. For example, refinancing federal student loans with a private lender means giving up federal protections, such as deferment, forbearance, and access to income-driven repayment plans.

That said, refinancing your student loans could make sense if you have a strong income, the ability to repay them, and you want to pay off your loans with a lower interest rate. As an example, the interest rate on Direct Subsidized Loans and Direct Unsubsidized Loans (for undergraduate students) will increase to 4.99% for borrowers who take out federal student loans during the 2022-2023 academic year. However, many private student loan companies offer fixed and variable interest rates that are much lower than that.

Use our student loan repayment calculator to discover how you can pay off your student loans.

Expert Advice About Student Loans

To ensure we share the best and most comprehensive information on student loan debt, we reached out to an expert in this field.

Expert Contributor

Mark Kantrowitz is the author of several books on higher education, including How to Appeal for More College Financial Aid and Who Graduates from College? Who Doesn't?. Kantrowitz is frequently called upon for his expertise on all things higher education, and he is considered the nation's leading expert on student loans.

Why Should Students Take Advantage of Federal Student Loans Before Private Student Loans?

Kantrowitz: Federal student loans have low, fixed interest rates that do not depend on the borrower's credit scores or require a cosigner. They are easier to get, generally cost less than private student loans, and have more flexible repayment, such as longer deferments and forbearances, income-driven repayment plans, and loan forgiveness and discharge options.

When Does It Make Sense To Use Private Student Loans?

Kantrowitz: Federal student loans have annual and aggregate loan limits. When a student reaches these loan limits, they may need to borrow from private and parent loans, especially at higher-cost colleges. Private student loans may also have competitive interest rates when the borrower (or their cosigner) has very good credit.

What Steps Can Students Take To Avoid Borrowing More Than They Should for College?

Kantrowitz: There are several ways to avoid borrowing too much, including the following:

Focus on free money first, such as grants and scholarships, which don't need to be repaid. Enroll at a less expensive college, such as an in-state public college.

Buy used textbooks and sell them back to the bookstore at the end of the term.

Minimize the number of trips home from school.

Work a part-time job (no more than 12 hours a week during the academic year) to earn money to help pay for college.

Minimize other expenses you have, such as costs for housing and transportation.

How Can Someone Decide How Much Student Loan Debt Is “Too Much?”

Kantrowitz: Students should avoid borrowing more for their entire education than their expected annual starting salary. If total debt exceeds annual income, they will struggle to pay their monthly student loan payments under standard 10-year repayment, and may need an extended or income-driven repayment plan.

EXPERT TIP

Students should avoid borrowing more for their entire education than their expected annual starting salary.

These repayment plans cut the monthly loan payments by increasing the repayment term, which also increases the total interest paid over the life of the loan. If you need to borrow more than the federal student loan limits, you may be borrowing too much.

What Advice Do You Have for Future College Students Who Are Trying To Get the Best ROI Out of Their College Experience?

Kantrowitz: Minimizing college costs is the key to maximizing the return on your college investment. Steps you can take to boost your ROI for college include the following:

Shop around by applying for admission to several colleges. College costs and financial aid differ by college, so applying to several colleges will give you more affordable options.

Apply to a financial aid safety school, which is a college that will not only admit you, but where you could afford to enroll even if you did not receive any financial aid. This is usually an in-state public college.

Apply to a mix of colleges, not just high-cost private colleges that use the CSS Profile form. Use each college's net price calculator to get a personalized estimate of the one-year net price to enroll at that college.

Take enough credits to graduate on time. Even though 12 credits a term is considered full-time, you will need to take 15 credits each term to graduate in four years.

File the FAFSA to apply for financial aid from the federal and state governments as well as most colleges and universities.

Search for scholarships on free scholarship matching websites, such as Fastweb and the College Board's Big Future. Apply for all the scholarships you believe you're eligible for.

Claim the American Opportunity Tax Credit and the Student Loan Interest Deduction on your federal income tax return.

Related Articles

Student loan forgiveness is a band-aid. What will really solve the problem?

Experts weigh in on what needs to happen to stop tomorrow's students from drowning in debt.

By OnlineU Staff Writers | 11/21/2022